MySST Portal Submission 506. Item 4 is the Final SST submission date by default the.

SQL - SST Listing 106.

. To view Sales Tax License Information and Sales Tax Return Schedule. The return must be submitted regardless of whether there is any tax to be paid or not. How to register and start using MySST Online.

Companies have to declare SST return SST-01 every 2 months bi-monthly according to the taxable period. SQL - SST Listing 106. CUKAI PERKHIDMATAN SERVICE TAX.

Go to Tax Setup General ledger parameters. Alternatively payments by Cheque or Bank Drafts on the name of Ketua Pengarah Kastam Malaysia can be submitted by post to Customs Processing Center CPC. SST Registration Number Please state CJ CP number.

Ii How to Apply Online for Registration. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. To Submit Sales Tax Return.

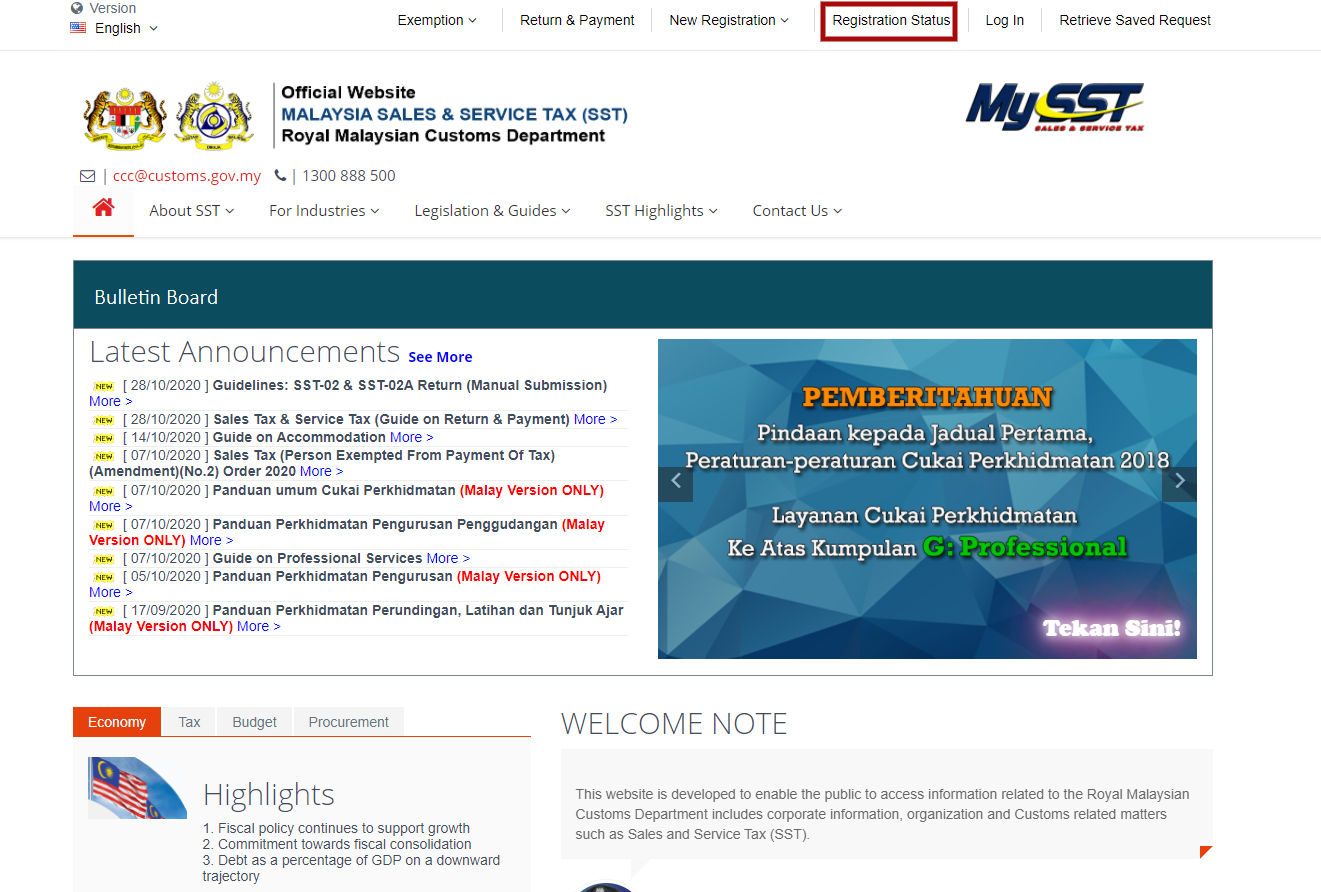

MySST Portal Submission 506. How to submit SST-02 Return Sales Tax. After generating your SST return report you will still need to submit your SST return to the governments website httpsmysstcustomsgovmy.

SQL - SST Listing 106. I User Manual Registration Click Here. Https Mysst Customs Gov My Assets Document Sst User 20manual 20public 20user 20v1 0 Pdf.

Where a registered persons taxable period does not end on the last day of the month the SST-02 return should be furnished no later than the last day of the. 2 Nama Pengilang Berdaftar Orang berdaftar ABC Company. How to submit SST-02 Service Tax via MySST 010.

REGISTERED PERSON PARTICULARS PARTICULARS EXPLANATORY NOTES 1 Type of return Please tick the type of return applicable. The payment can be made by bank. 如何呈报服务税SST-02报表 How to submit SST-02 Service Tax via MySST by Mr.

How To Submit Sst Malaysia Online. Registration is required for new user. AH - ANC Hub 教你如何呈报服务税SST-02报表 How to submit SST-02 Service Tax via MySST 010.

The return can be submitted through. Pendaftaran SST SST Registration No 88888888888888888. After the return submission in the same portal the payment is made via FPX facility with 17 banks to choose from.

There are two ways to file the SST return. LAST DATE TO FURNISH THE SST-02 RETURN 21. This will guide you on how to make the return and payment through online at Official Website of Malaysia Sales Service Tax SST.

Malaysia Sales Sales Tax SST. You must submit your Tax Return electronically via httpsmysstcustomsgovmy and payments can be made after return submission in the same portal via FPX facility with 17 banks to choose from. The SST return is required to be furnished to the DG no later than the last day of the month following the end of the taxable period.

Item 1 and 2 this information are related to the SST Type and Company name. The sst is also applied to the importation of taxable goods into malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of products. Check Past Service Tax.

Sections of this page. The manual guide covered topics of below. Go to httpsmysstcustomsgovmy to login.

REGISTERED MANUFACTURER REGISTERED PERSON PARTICULARS. Guidelines Sales Tax Service Tax Return SST-02 Click. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

SST 02 SALES TAX SERVICES TAX RETURN PART A. 48 rows SST-02 Form. The guideline below will help you to fill in the Form SST-02 manually.

SST return has to be submitted not later than the last day of the following month after the taxable period ended. How to submit SST-02 Service Tax via MySST 010. On the Sales tax tab in the Tax options section in the Electronic reporting field select SST-02 Declaration Excel MY.

Pk 42 surat setuju terima sst pesanan kerajaan dan. Song Liew of AH - ANC Hub. Online Payment a Procedure to Login Return Payment.

Full Hos Solution Sdn Bhd -. Alternatively you can download Form SST-02 from the MySST portal and mail it to CPCCustoms Processing Centre by post. You need to submit your Tax Return online via the CJP system.

Name of Registered Manufacturer Registered Person 3 Tempoh Bercukai Taxable Period dari. Item 3 is related to the Taxable Period this value will be based on your date range set in the SST Period. When youre in MySST portal click on Log In button to login to your account.

For new applicant you may need to apply online at httpmysstcustomsgovmy. Check Past Service Tax. To generate the SST-02 return form report in Excel you must define an ER format on the General ledger parameters page.

MySST Portal Submission 506. For a company with Service Tax then the information will be shown under the Service column. User ID and password will be given to AUTHORISED PERSON only to login.

Sst 02 Tax Payable Rounding Adjustment Youtube

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysian Service Tax Submission 2018 Mandarin Youtube

Sst How To Declare Sst Return In Treezsoft Treezsoft Blog

Bryan Cheong Sst 02 And Sst Tax Code English Teaching Youtube

Full Hos Solution Sdn Bhd How To Submit Sst 02 Facebook By Full Hos Solution Sdn Bhd 如何呈报服务税sst 02报表 How To Submit Sst 02 Service Tax Via Mysst 0 10 Sql

Malaysia Sst Sales And Service Tax A Complete Guide

Sst Filling Extended Deadlines Due To Mco Yau Co

Sst02 Form Guide On Sales Service Tax Sst Listing Youtube

Sst How To Declare Sst Return In Treezsoft Treezsoft Blog